The aluminium price has been down for 4 months in both China and ROW. It climbed up after the Chinese New Year holidays, and is now showing support above RMB 11,000. At the same time, inventory levels reported at Shanghai also rose. Normally increased prices is a sign of tight inventory, not growing stock levels. But in the last weeks inventory levels have risen in line with prices.

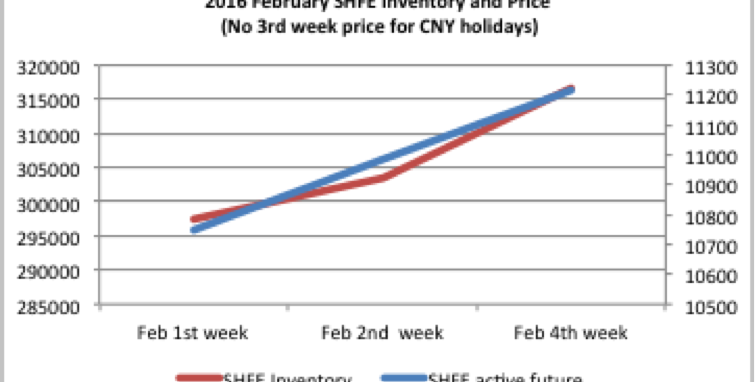

SHFE inventory has been increasing since 29th of January. It was 296Kt on 29th of January and it climbed to 316kt on 26th of February. That is a 7% increase, while Shanghai prices have risen by about 5% in the same time. When we look at LME inventory, we saw a different trend on inventory. LME inventory dropped 32.6Kt in February compared to January. In the meantime, LME prices increased. Why are the two markets displaying opposite relationships between price and inventory?

The Kunming Meeting in December and the news of Commercial Stockpiling seem to have reduced aluminum production. We have reported before that production data is unreliable, but the trends showing in the data support the feedback we are getting from the market. Although general sentiment regarding the Chinese economy remains muted, the talk of closures has put upward pressure on price. And despite a general softness in demand sectors, there are some positive items, for instance in automobiles and now with the Government’s push on clearing inventory of houses and apartments.

So the price was going to rise anyway, but why are stocks rising, if production is reducing? In China the question of “invisible inventory” is no longer the hot topic it used to be 2-3 years ago. But just because the heat has gone out of the discussion, doesn’t reduce the amount of metal held off market. Metal held as collateral, unreported production, metal exchanged in lieu of payment, and various other invisible stocks continue to sit latent in the supply chain. Some of this metal has no doubt been obtained at very low prices, which is what happens when producers are in distress. Now that prices are rising, we think some traders, bankers and producers are taking the chance to grab the improved price. The outlook is not very positive, so the chance to grab a relatively good price may not last long.

Any sign that the RMB 12,000 line is in sight will likely cause some smelters to re-enter the market. That will mean more metal in the supply chain, more inventory, but lower prices. The SHFE would likely return to emulating the LME.

No comments

Be the first to leave a comment.