Published every month, this report provides you with the latest information on the primary aluminium and raw materials markets in China.

AZ China has access to a host of primary and secondary sources inside China. As part of our quest to de-mystify China and to help you to understand the Chinese market better, each month this report provides quality analysis and expert commentary on the trends in the various markets and industries.

We start from the top down, looking at the Chinese economic situation, and how that affects the aluminium and raw materials sectors. We look inside the China domestic market for signals as to the direction of the industry, and provide expert analysis of the import and export situation.

AZ China’s World Aluminium Monthly brings you all you need to know about developments in the industry and trends in the market. Each month we provide a full suite of data together with commentary and analysis. The World Aluminium Monthly also includes a “Hot Topics” section, in which we debate the latest developments, to give you a better understanding of how things are likely to turn out. The World Aluminium Monthly is another way in which AZ China provides knowledge and intelligence, not just a report.

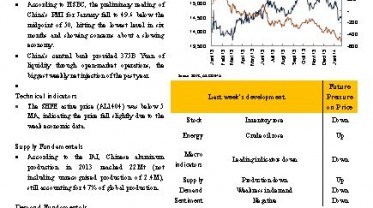

The Weekly Aluminium Alert gives you all the important news on a single page. AZ China is the only company who not only gives you our forecast, we tell you when we were wrong. No other aluminium expert does this.

Sent on a weekly basis, this review gives you an instant snapshot of China’s economy, energy, aluminium and related raw materials markets. With the Weekly Market Review, you know what is going on in the aluminium raw materials market in China within minutes.

The India Report is produced on the ground inside the Indian market by local experts, and jointly distributed by AZ China and GOA Petcoke Consulting. The report is issued every month, so the data is accurate and up-to-date. The scope covers the India economy, aluminium industry, and the full range of raw materials. Also included is a detailed analysis of import and export data.

You want information. You want knowledge and understanding. That’s why you should consider AZ China to get the market intelligence you need.

Sometimes a generic report just doesn’t quite tell you what you need to know. While our suite of reports cover lots of topics, and while we have an excellent reputation for the quality and accuracy of our data, sometimes there’s a particular question that you need answered.

Consider some of the questions we have tackled for clients in the past:

What’s the structure of China’s electricity system, and does China have enough electricity generation to supply its growing aluminium capacity?

Where can I find grain refiners and master alloys from? Which suppliers are best?

What’s the outlook for the world’s supply of anode grade green coke?

Will China’s aluminium industry be constrained by shortage of bauxite/alumina?

How much is my competitor paying for his supply?

Please help me to source semi-finished aluminium from China.

If you have questions, we have the answers. Contact us today, at [email protected].

Monthly Pipeline - Closures, new capacities, & mergers of Chinese smelters on a monthly basis.

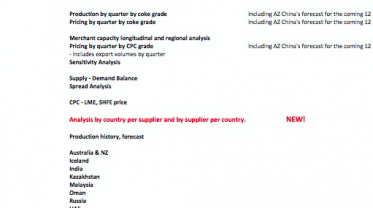

Available only to Black China Report subscribers, the Semester Pricing Handbook can assist you with your calcined coke purchases, especially from China. We have specifically designed this tool to be useful for both sides of the negotiation. It doesn’t matter if you are a buyer or seller, you need to be well prepared. We know that many of you have to trawl through numerous reports and studies to extract the information you need. So we thought we would do it for you. Hopefully we can free you from the task of extracting data, giving you more time to analyse data and make good decisions.

AZ China has joined with Cascade Resources and Consulting and Turner, Mason & Company to produce the most definitive analysis of the supply of anode coke through to 2025.

This deep-dive study has been 3 months in the making, with teams in the USA and China building the most comprehensive analysis of the trends and likely developments in the petroleum coke market.

The process of making aluminium consumes almost 500kgs for every ton of aluminium produced, so this material is a vital part of the world’s primary metal industry. But petroleum coke - the source of the carbon used - is driven by the economics of crude oil and oil refining, not aluminium. Already countries such as China are consuming grades of petroleum coke that are poor quality, resulting in higher environmental emissions and poorer performance and lower efficiency from the electrolysis process.

AZ China, Cascade Resources and Turner, Mason have compiled a comprehensive table of all the world’s suppliers of anode grade petroleum coke, and matched that with global demand from the aluminium industry, and other consumers of the material. This study will be released at the end of August 2015.

Not sure? Check the Table of contents in the link.

For more information about the study, including pricing, contact us at AZ China.