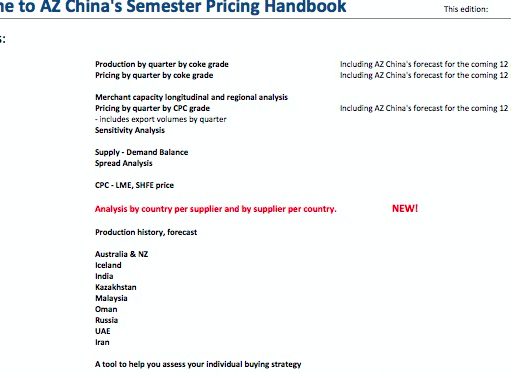

AZ China is about to issue the latest edition of the Semester Pricing Handbook, our quarterly publication designed to support anyone negotiating petcoke or CPC contracts. That includes buyers and sellers.

There has been a lot of close scrutiny on calcined coke prices, especially since last year when prices dived, and some buyers capitalized on a weak market. So let’s have a little quiz about calcined coke and the market for this product. See how many questions you can get right (there’s no prize other than the boost to your ego.)

- Which country paid a higher average price for calcined coke in Q3 2016? Iran or Russia?

- Which country bought the most calcined coke from China in Q3? UAE or India?

- Which country paid an average price of $214/t for their calcined coke? Australia, Montenegro or South Africa?

- Which Chinese calcined coke supplier had the lowest average price for the quarter ($206)? Weifang Lianxing or Jiangsu Yuan?

- Who shipped the most calcined coke in Q3? Suyadi or ZCGG? (Yes, it’s essentially the same company, but Customs data shows transactions for both entities.)

These questions come from the calcined coke section of the Semester Pricing Handbook, but there is an equal wealth of data in the petcoke sections. For instance, what is the relationship between crude oil prices and petcoke prices? Is China producing more or less anode grade petcoke now than 12 months ago? How many of China’s oil refineries produce petcoke?

If you would like more information on the Semester Pricing Handbook, please contact us here at AZ China. I will publish the correct answers for these questions in a few days.

No comments

Be the first to leave a comment.