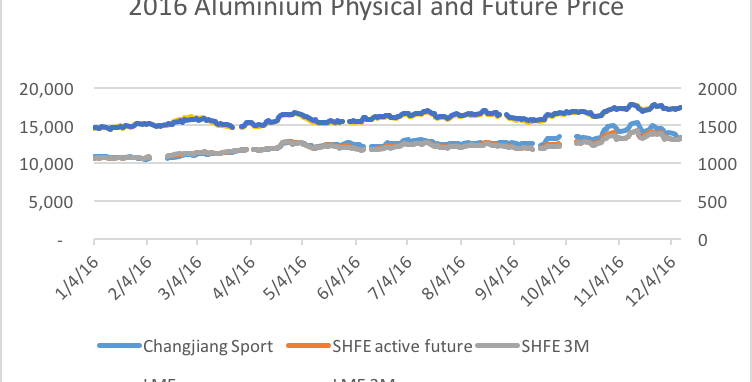

The aluminum price firmed in both China and the world market in 2016. From the price analysis, the China aluminum price was in backwardation since 18th of May. It showed the strong domestic demand in May with the support of a strong real estate market.

When we entered the low season for the aluminum industry in China, some unusual figures in September caught our attention. The aluminum price continued the backwardation trend and the spread between physical and future price widened to RMB1015 on September 30th. The new transportation policy in China inaugurated September 28th caused ingots to be in short supply and caused an increase in the Chinese aluminum.

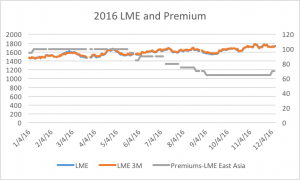

The strong aluminum price in China pushed up the LME price in London. The LME cash broke USD1700 on 28th of October. The LME performed much steadier than the Chinese aluminum price, which showed how the speculators play a very important role in the China aluminum market.

When snow began falling in Xinjiang ingot inventory was already low due to the impact of the new transportation policy. This created panic buying. The speculative money rotated from the cooling real estate market and entered the commodity market early November. During the U.S. presidential election period, when Doland Trump was announced to be the next U.S. president, the commodity price including aluminum price rallied, setting the year’s high record. All these factors stimulated the China aluminum price to rise significantly by early November. The spread between the Changjiang spot and SHFE active price remained over RMB1000 in backwardation for a week.

November was supposed to be the low season in China and we found there was no solid demand support the aluminum price. As soon as the transportation problem was solved temporarily in December, the aluminum price started to decline. The spread between Changjiang and SHFE narrowed to RMB90 on 9th of December when the inventory rose.

We noticed the LME price was trending opposite with Chinese price at this time. Since the LME price historically tracks the Chinese aluminum price, we will expect to see the LME price may pick up the changes in China market soon.

We also noticed the strong negative correlation between LME price and premium. When the LME price was high, the premium declines to increase liquidity in the inventory. Many aluminum smelters in the world market started contacting their clients directly to increase the sales. On the contrary, when the LME price declines, the premium increases through less sales in the market. Compared to the China market, the LME physical and future price showed contango most of the year and started going into backwardation since the beginning of December. Since the probability of the U.S. FED increasing the interest rate in December is nearly 100%, the LME price will probably meet strong downward pressure by middle to late December.

Overall, as the producer of more than half of the global primary aluminum, the Chinese aluminum pricing played a very important role in the world aluminum market. The LME price usually tracks the Chinese aluminum price trend. In 2016, the Chinese aluminum price was often influenced by policy changes and speculators. However, the LME price was much more stable than the Chinese price. It is our view that while the global aluminum market is interconnected, China plays a pivotal role in price movements. The AZ China team will continue to provide you a complete global picture with insight into both the Chinese and global aluminum market.

No comments

Be the first to leave a comment.