Monthly Archives: April 2009

Alumina

Imported alumina prices rose US$5-10/tonne to US$260-270/tonne. Meanwhile, domestic non-Chalco alumina prices remained unchanged at RMB2350-2370/tonne, and the Chalco price stayed stable at RMB2300/tonne.

Aluminium

Last week, Chalco`s aluminium price remained unchanged at RMB13800/tone. According to National Bureau of Statistics data, China produced 902,300 tonnes of primary aluminium in March 2009, more than in February 2009, but less than in March of last year.

Green Petroleum Coke

The green coke market remained weak last week. After several weeks of uncertainty, some refineries cut their prices again, so that although a few plants increased list prices, the actual trade price did not change much.

For low sulphur coke, Jinxi petrochemicals lowered its price by RMB100/tonne to RMB1400/tonne. Due to pressure from poor sales, Jilin petrochemicals cut its price by another RMB100/tonne to RMB1100/tonne. Prices at other refineries remained unchanged

As for moderate sulphur coke in Northern China and Shandong province, Tianjin petrochemicals cut its price by another RMB50/tonne to RMB1050/tonne. Meanwhile, the Jinan refinery reduced its price by RMB50/tonne to RMB1250/tonne, and the Cangzhou refinery cut its price by RMB 70/tonne to RMB1180/tonne. Along the Yangzi River, the Jinmen refinery cut its price by RMB50/tonne to RMB1250/tonne, and the Anqing refinery decreased its price from RMB1430/tonne to RMB1300/tonne. The Changling refinery is planning to shut down for maintenance for around two months starting from 28 April. In Western china, the Kelamayi refinery will shut down for maintenance at the end of April. The list price of 3# coke has therefore been higher and remained around RMB 1450-1550/tonne lately.

The high sulphur coke market remained relatively stable. The Gaoqiao refinery increased its price lately and stabilized it at around RMB860-900/tonne, while the Qingdao refinery raised its price from RMB 780/tonne to RMB 820/tonne. The Qingdao refinery has scheduled output to reach 900,000 tonnes in 2009, and plans to use half of the production for its CFB boilers. It will build a new coker with processing capacity of 1.6 million tones, expected to come online by the end of 2009.

Calcined Coke

Low sulphur Calcined coke prices dropped RMB100/tonne to RMB2000-2100/tonne. Domestic demand for low sulphur calcined coke is very weak, especially in Northeastern China. There were few deals made in China, and most low sulphur calcined coke was exported.

Moderate sulphur and high sulphur calcined coke prices did not move last week. For Moderate sulphur, the price in Shandong province stayed at around RMB1400-1500/tonne, and while the price was slightly higher in Tianjin Yunhai at RMB1700/tonne, though the deal volume there was limited. High sulphur calcined coke sales were also relatively weak, and mostly geared towards exports. Prices stand at around RMB1350-1400/tonne.

Anode

China’s anode market saw some improvement last week thanks to the resumption of aluminium production. Last week saw greater deal flow and prices rose slightly.

Mainstream prices stayed at around RMB2600-2800/tonne in Shandong province, RMB2500-2800/tonne in Henan province, RMB2700-2900/tonne in Shanxi province, and RMB3000/tonne in Inner Mongolia. Meanwhile, some price improvement was noted in Guangxi and Chongqing provinces, where prices reached RMB3000-3100/tonne and RMB2850-3000/tonne respectively.

Coal Tar

Coal tar prices continued to rise last week. While prices did not move in Shanxi province, where they mostly stayed around RMB2500-2600/tonne, prices rose to RMB2700-2800/tonne in Hebei, Shandong and Jiangsu provinces, and RMB200-250/tonne to RMB2100/tonne in Inner Mongolia. Meanwhile, prices in South China also increased slightly.

Market supply still remains very tight. We expect to see prices climb further.

Coal Tar Pitch

Last week saw domestic coal tar pitch prices begin to stabilize, with only a few isolated increases. In Shanxi province, modified pitch prices remained unchanged at RMB2700-2800/tonne, while the moderate temperature pitch price rose RMB100/tonne to RMB2600/tonne. In Hebei province, modified pitch prices stayed put at RMB2800/tonne, while the moderate temperature pitch price rose RMB100/tonne to RMB2500/tonne. In Shandong province, modified pitch prices remained stable at RMB2700-2800/tonne, while the price for moderate temperature pitch rose RMB100/tonne to RMB2250-2400/tonne.

Coal tar pitch prices are expected to rise further, but only marginally.

Cathode

Nothing new to report this week

Aluminium Fluoride

Nothing new to report this week.

Doctor Ulrich Mannweiler is perhaps better known to many of us simply as Manny. I caught up with Manny when he was in Beijing recently, and asked him about his views on the market.

Manny, thanks for agreeing to this interview. You are certainly a well-known and well-respected identity in the industry. Can you tell me a little of your history in the aluminium and carbon industries? When did it all begin?

After finishing my Chemistry studies in 1965 at the University of Bern, Switzerland, I was employed by Swiss Aluminum Ltd. with whom I held various management positions in Europe and the United States in primary aluminum, coke and anode manufacturing, research & development and technology sales. I had my first Chinese contacts in 1984 when I unsuccessfully tried to sell aluminium technologies. I was too young, inexperienced and impatient to successfully negotiate with the Chinese partners.

In 1988, I joined R&D Carbon Ltd. where I was responsible for business development, technology transfer and international relations. In the late 1990’s I started to develop the Chinese market for products and technologies of R&D Carbon Ltd, and AMINCO Resources, a New York based trading company.

After my retirement from R&D Carbon Ltd in 2002, I created my own company MANNWEILER CONSULTING, which continues to serve R&D Carbon Ltd. and AMINCO Resources as well as other companies in the field of carbon technology, international relations and cooperation with the Chinese aluminum, oil and carbon industries.

Actually, I am intensively working on a project to transfer a well-established Chinese petroleum coke calcining technology to the West, where it has been forgotten for over seventy years!

You have been on both sides of the fence, so to speak, in both aluminium and carbon. Do you think that the two industries understand each other sufficiently?

For a long time carbon products, i.e. petroleum coke, coal tar pitch, anodes and cathodes were considered just as a commodity. It was taken as granted, that carbon product suppliers had to supply according to smelter specifications. With the continuous deterioration of petroleum coke quality, any carbon product, mainly anodes, becomes so important, as its quality dramatically influences the anode behaviour in the reduction cell mainly regarding pot performance, metal quality and its tremendous impact on Green House Gas emissions. This quality awareness of the consumers and the producers of carbon products must be maintained or increased by all concerned. This is a great challenge for those who understand how to produce and sell quality carbon products.

You have spent many years in the industry. What do you think are the major changes over those years? Is it getting more or less professional, for instance, or more or less demanding?

Unfortunately, I see a great lack of industrial professionalism. Everything is driven by the financial short-term performance. What I am personally missing are the people that have a great lateral understanding, that are aware of our history, that are creative and have a sense of thinking forward, not only for three months but for many years ahead of us. That is what we can learn from the Chinese, who have a fifty-year planning horizon. The eagerness to learn, the readiness to work hard combined with long term goals will make the new Chinese professional community very, very strong.

You told me that at one time you refused to go to China. Yet a few years later, you published probably the seminal work on the China crude oil and pet coke market. What caused you to make the transition into becoming a China expert?

Well, I explained earlier that 25 years ago I was unsuccessful with my first technology transfer deals from Europe to China. I was just too young and inexperienced to see what challenges laid ahead. When in 1998 I came back, China had changed much. It became more open, more flexible, more eager to learn from us and not only to take from us. Also I had changed. I was ready to listen to the Chinese, I became interested in their history and way of thinking and I identified a tremendous potential for our business. I saw that the general Chinese understanding in carbon technology and quality was very poor. The Chinese partners knew of their lack in knowledge and were ready to learn from us. It was and continues to be a “win-win” situation for both of us.

How did publishing that work on China change your business life? Did you find yourself becoming more sought after?

I guess I was the one who took the most advantage out of this work, since I started to understand better, why the Chinese Aluminium Industry was suffering so much from bad anode quality. This knowledge led then into a cooperation with a Chinese research group. We invited a young doctor student to perform a thesis on “Chinese Raw Materials for Anode Manufacturing”. With the knowledge that I had gathered on China’s crude oil situation and pet coke market, I could formulate the goals for that thesis.

Since you moved into consulting, you have published many papers, given countless presentations, consulted to many clients, and even run two very successful conferences. Which of these activities brings you more personal satisfaction?

I guess it is the combination of all. It is a great satisfaction to me to let the industry share with me my long experience, my lateral understanding in the field of carbon technology and also my experience in doing successful business in China.

When you first started dealing with China, the coke here was predominantly anode grade. Over the years, that situation has changed, with the heavy reliance on imports spoiling the picture. Do opportunities still exist for smelters to find reliable sources of AG coke, or is that a thing of the past?

China’s own crude oil reserves do not grow. With the continued growth of Chinese GNP, the demand for crude oil from abroad will steadily increase. This imported oil is mostly of high sulphur and metal levels, which means that the resulting pet coke will be a fuel coke. Since also the Chinese aluminium industry is growing steadily, their requirement for anode grade coke will grow. Moreover, it is very clear that the local industry will first be served with good quality coke, before exports are allowed. This will have an impact on coke prices. First it was the drop of the “rebate”, and now it has to be expected that the government will impose export taxes on anode grade coke. There will be always limited quantities of aluminium grade coke available for export (at what price?) but the rest of the World has to find other sources of low sulphur, metal coke to be used to make good anodes. Such new sources have been discovered but need to be developed first. This is a technological and economical challenge to the industry.

Manny, it seems many of the players in this market are in the second half (or later) of their business life, with many of the “identities” now retired or retiring soon. Do you think the industry is doing enough to develop “new blood”, to bring new specialists in?

I hope I am wrong, but I doubt that enough new “blood” is being created. However, I have no recipe to remedy this situation. I only can tell the young engineers work hard, learn from the history, open your horizon and look positively in the future!

Finally, I know you have a great family around you. Would you mind telling me about them?

My family is the most important thing for me. I am very fortunate, that my three grown-up children are living very close from where my wife and I do live. I have three wonderful grandchildren, a boy of seven and two little girls of four. In a few months my youngest son with his Japanese wife are expecting their first child. What a joy for our whole family.

The following article appeared in today’s China Daily. They give predominance to the CASS forecast, which is the most optimistic. This think-tank has proven itself to be very reliable and accurate in its publications, so is worth following.

The Chinese economy is projected to grow 8.3 percent this year, according to a report released by the Chinese Academy of Social Sciences (CASS).

“Since there is a decline in exports, economic growth will mainly depend on consumption and investment. We expect consumption to contribute 4.3 percentage points to GDP growth, while investment may contribute 2 percentage points,” CASS said.

CASS economists said total investment in fixed assets, a key requirement for an 8 percent growth target, was likely to range between 21 and 23 trillion yuan.

Growth in exports and imports, however, may remain negative the whole year, the report warned.

Exports growth may fall by 2.4 percent and imports would decline by 3 percent, it forecast. The total trade surplus for the year was likely to touch $280 billion, CASS said.

The Academy said the consumer price index (CPI) might rise by only 0.8 percent for the year, a significant decline from the earlier forecast of 4.3 percent.

Retail sales may touch 12.5 trillion yuan, an increase of 14 percent year on year, it said. This is 1.6 percentage points higher than CASS’ earlier forecast.

The CASS report has suggested that China should improve domestic consumption in three spheres - rural areas, real estate and infrastructure.

“The government should cut taxes on companies and individuals to increase income in order to boost individual consumption,” Cai Fang, director of the Institute of Population and Labor Economics in the CASS, said.

Meanwhile, a Standard Chartered Bank report on Tuesdaypredicted a lower GDP growth for China in 2009. The bank said its GDP forecast for the country would remain unchanged, at 6.8 percent for the year.

“China’s economy seems to have bounced back in March, thanks to infrastructure spending. However, we wonder about the sustainability of this rebound,” it said.

“China’s economy is investment-dominated. In 2008, investment accounted for 43 percent of all spending, measured from the expenditure side of the national accounts. Consumption accounted for 36 percent, and looks to remain at about this level over the next few years,” Stephen Green, the banks’ head of research said.

Earlier, UBS had upgraded China’s 2009 GDP growth forecast to between 7 and 7.5 percent on very strong stimulus-related bank lending growth.

“The government’s attempt to boost consumption relative to investment and exports is a long-term project. It will depend on bringing incomes up to rich-world levels and completing the social welfare system, and neither is likely to happen in the short term.

In the short term, the stimulus package looks set to boost investment,” Green said.

Alumina

Market demand for alumina has increased with the recent resumption of aluminium production. Last week, alumina prices rose slightly. Imported alumina prices were up US$5-10/tonne to US$250-265/tonne. The domestic non-Chalco alumina price rose RMB20-50/tonne to RMB2350-2370/tonne. The Chalco price remained unchanged at RMB2300/tonne.

Aluminium

The situation on the Chinese aluminium market changed last week following the completion of the government reserves purchases program. Production capacity coming back on line has pushed up market supply, while demand remained weak -and this resulted in a drop in Chalco`s aluminium price, RMB 900-1100/tonne to RMB13800/tonne. Meanwhile, Guangdong province saw the lowest domestic non-Chalco price at RMB13420/tonne, and we even saw some low-end aluminium priced at RMB13300/tonne.

Green Petroleum Coke

Last week saw fluctuations within the coke market. However, more refineries lowered their prices than raised their prices, and the market remains set on a downturn trend.

On the supply side, both Sinopec and Petrochina have been gradually increasing the volume of crude oil being processed since March. As a result, coke production has seen significant growth in Eastern and Southern China. Going forward, crude oil processing volumes will likely continue to grow given the upward trend in the refined oil products market lately, and coke output should increase further as cokers in local refineries with output capacity of around 5 million tonnes fully resumed production last week. Although domestic supply of coke may begin to decline after May, with the Changling, Zhenhai and Liaoyang petrochemical plants shut down for overhauling and maintenance, significant quantities of imported coke are expected to come in between the end of April and May. This supply, combined with coke imported earlier and still in inventory, is expected to result in significant supply of petroleum coke in China over coming months.

On the demand side, the market for coke remains soft. First, the Chinese government’s primary aluminum reserves purchase program has come to an end, and with this the domestic aluminium market has begun to weaken again, leading to weaker downstream demand for coke. Second, customs data show a 50% drop in anode and electrode exports over the first two months of 2009 compared with the same period last year, and the slump in export markets is expected to extend into May 2009. Third, over 50% of China’s steel sector’s output has been suspended, causing a sharp decrease in demand for coke from the electrode industry. Finally, the demand for coke from industrial silicon producers and other sectors is expected to remain subdued. Overall, the outlook for coke downstream demand is therefore relatively negative, and it is not anticipated the situation will improve anytime soon.

To sum things up, the recent price rebound at some refineries lacks support, and the current situation will make it difficult to curb the downward pricing trend for petroleum coke. The coke market is expected to stay weak while it consolidates.

Calcined Coke

Quoted prices for low sulphur and high sulphur calcined coke remained unchanged last week. Low sulphur CPC saw a slight decrease in deal prices, but was mostly these trades were for export. Jinxi low sulphur CPC was selling for as low as RMB2000/tonne, while their GPC sold for RMB1500/tonne. In some cases, high sulphur CPC prices rose last week, driven up by rising high sulphur GPC prices (from Gaoqiao Petro-chemical, Shanghai Petro-chemical, and Qingdao Petro-chemical).

On the other hand, moderate sulphur calcined coke prices dropped RMB100/tonne to RMB1400-1500/tonne as a result of the soft aluminium market.

Anode

Nothing to report

Coal Tar

Coal tar prices continued to rise last week. The price in Shanxi province increased RMB200-300/tonne to RMB2500/tonne, and rose to RMB2200/tonne, while in Hunan province, while Hebei, Shandong, and Zhejiang provinces prices edged up RMB400/tonne to RMB2600-2800/tonne.

Market supply remains very tight.

Coal Tar Pitch

Domestic coal tar pitch prices continued to rise last week along with coal tar prices. In Shanxi province, modified pitch prices rose RMB300/tonne to RMB2700-2800/tonne, and moderate temperature pitch prices rose RMB150-300/tonne to RMB2500/tonne. In Hebei province, modified pitch prices rose RMB300-400/tonne to RMB2800/tonne, while the price for moderate temperature pitch remained unchanged at RMB2400/tonne. In Shandong province, modified pitch prices rose RMB100-150/tonne to RMB2700/tonne.

Coal tar pitch prices are expected to rise further going forward.

Cathode,

Most producers have kept their prices stable, with the exception of a supplier from Shanxi province who has cut its 30% graphite block price by RMB200/tonne, to RMB 7600/tonne.

Aluminum Fluoride

The market for aluminium fluoride has been relatively stable lately. Listed prices for aluminium fluoride were RMB4800-5500/tonne, and the gap between listed and traded prices has further narrowed since the beginning of April. Quoted prices for aluminium fluoride (dry method) were RMB5000/tonne in Henan province (except for Do Fu Do), RMB4900/tonne in Shandong province, and RMB4800/tonne in Zhejiang province. In Fujian province, the production of aluminium fluoride was stable, and quoted prices stood at RMB5200/tonne for the domestic market, and at USD1120/tonne FOB for the export market. The list price for wet method fluoride stayed unchanged at RMB4500/tonne.

The purchasing price for the raw material that is aluminum hydroxide has slightly increased -it currently stands at RMB1300-1550/tonne. This rise in raw materials may push aluminium fluoride prices up. The latest quotation for cryolite was RMB5000-5800/tonne.

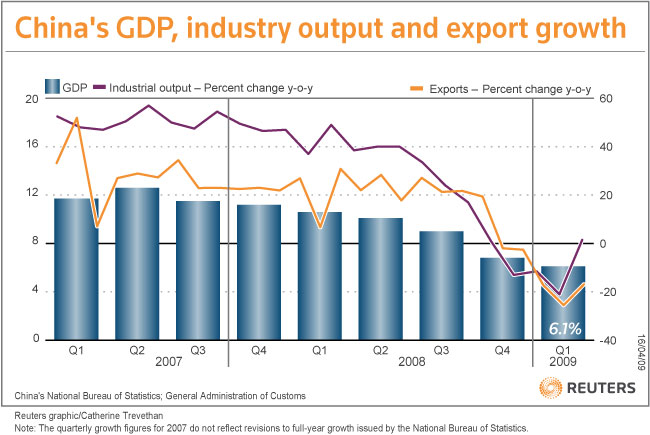

Acknowledgements to Reuters for this story. For China’s four economic levers, exports are the one which continue to weigh heavily on GDP growth. Government spending and investment are both strong, though perhaps not for the right reasons. The fourth lever, consumer spending, is not directly addressed here. But with inflation much lower and with the focus on job growth through public and private investment, it’s only a matter of time before we see an acceleration in this area as well.

China GDP growth slows to record low

By Simon Rabinovitch and Zhou Xin

BEIJING (Reuters) - China’s economy slowed in the first quarter to its weakest pace on record, but an improvement in data for March offers tentative signs that the worst may be over for the world’s third-largest economy.

Annual gross domestic product growth fell to 6.1 percent, down from 6.8 percent in the fourth quarter of 2008 and slightly below economists’ forecasts of a 6.3 percent rise.

That marks the weakest growth since quarterly records began in 1992.

Growth was dragged down largely by a sharp fall in exports in the first three months, but was offset somewhat by the implementation of the government’s 4 trillion yuan ($585 billion) stimulus package, which helped prompt a surge in lending in the first quarter.

Annual growth in urban fixed-asset investment surged unexpectedly to 28.6 percent in the first three months, while industrial output growth rebounded to 8.3 percent in March, from a record low 3.8 percent in the first two months of the year.

“The overall national economy showed positive changes, with better performance than expected,” Li Xiaochao, spokesman for the National Bureau of Statistics, said at a news conference on Thursday.

Still, Li said the drop in exports was leading to falling corporate profits, reducing government revenues and increasing difficulties in creating jobs.

“The national economy is confronted with the pressure of a slowdown,” he said.

“STILL OKAY”

Commodities markets, which had already braced for a slowdown in the first quarter, took the news in stride. Oil and copper prices were little changed after the figures released, holding on to earlier gains.

The yen gained against the dollar and other major currencies after the data. Currencies such as the Australian dollar and sterling had been bought against the yen ahead of the data on speculation it might be higher than forecast.

“Of course this number is a record low, but everybody expected that. It’s still an okay number which shows China is bottoming out,” said Sebastien Barbe, senior economist with Calyon in Hong Kong.

“The previous number was only slightly above this, so that means the deceleration is not so strong and the policy response — a lot of bank lending and investment by state-owned companies — is helping contain the slowdown.”

Alumina

Last week, alumina prices increased only slightly. Imported alumina prices rose US$15/tonne to US$245-255/tonne. On the other hand, the domestic non-Chalco alumina price remained unchanged at RMB2300-2350/tonne. The Chalco price also remained stable at RMB2300/tonne.

Aluminium

Reserves building by the central government and at the provincial level had a stronger market impact over the past week, with Chalco’s aluminium price rising RMB600/tonne to RMB14700-14900/tonne. That being said, domestic aluminium demand is not showing any signs of significant improvement, and supply is about to rise as shut capacity has either come back online or is preparing to do so in view the recent price increases. All these factors are likely to put a lot of pressure on aluminium prices going forward, and the positive price trend is expected to end very soon.

Rumor has it that from China will add a 5% tax on aluminium imports starting from May 1st.

Green Petroleum Coke

The coke market appears to have stopped deteriorating. Prices at most refineries remained stable last week, with only a few refineries cutting prices.

It is anticipated that the price of high sulphur coke in Eastern China may have already reached a bottom. Except for the Qingdao refinery, significantly affected by coke imports, other high sulphur coke refineries appear to be gradually coming under less selling pressure. The scope for price adjustment could further narrow down.

Gaoqiao refinery increased their price by RMB30/tonne, but this coke goes primarily into the anode industry. Although it is a high sulphur coke, the low metals content makes it an ideal blend coke. Gaoqiao prices follow the aluminium market more than the coke market.

In the moderate sulphur coke market, the price of coke stabilized at around RMB1150/tonne along the Yangtze river. Affected by rising operating rates at Shandong local refineries, the Tianjin refinery coke price dropped RMB90/tonne to RMB 1150/tonne.

In the low sulphur coke market of Northeastern China, demand from downstream electrode plants remained soft. In order to boost sales, refineries there may cut coke prices in the near future.

Calcined coke

Calcined coke quoted prices did not move last week, but the actual deal prices for low sulphur, moderate sulphur and high sulphur all dropped slightly. Market demand remained weak last week, and most producers’ inventory levels rose. Calcined coke prices are expected to fall further.

Coal tar

Coal tar suppliers accelerated price hikes again last week, with prices rising RMB200/tonne to RMB2200-2300/tonne in Shanxi province, up RMB200/tonne to RMB2300-2500/tonne in Hebei province, and up to RMB2300-2400/tonne in Shandong province.

The “demand exceeds supply” situation is worsening, and we have heard that a producer in Hebei province has already been importing cheaper coal tar from Japan.

Coal tar pitch

Last week saw domestic coal tar pitch prices continue to rise. In Shanxi province, modified pitch prices rose RMB350-400/tonne to RMB2400-2500/tonne, while moderate temperature pitch prices rose RMB200-350/tonne to RMB2200-2350/tonne. In Hebei province, modified pitch prices rose RMB100-200/tonne to RMB2400-2500/tonne, while moderate temperature pitch price rose RMB200-250/tonne to RMB2400/tonne. Meanwhile, in Shandong province, modified pitch prices rose RMB200-250 to RMB2550-2600/tonne.

Combined with weak market demand for coal tar pitch, the shortage of coal tar is making conditions very challenging for coal tar pitch producers -as reflected in last week’s prices, where coal tar pitch prices are very close to coal tar prices. As producers attempt to balance their costs of raw materials with their coal tar pitch selling prices, some producers have begun to turn towards importing coal tar from outside China.

Anode

Over the past week, while mainstream quoted prices for anode rose along with aluminium prices, actual deal prices remained around RMB2600-2800/tonne due to soft market demand. Last week also saw very few deals being made.

It is anticipated that the anode market will move very much in step with the aluminium market. With many anode producers planning to come back to the market, domestic anode market supply is expected to increase. Meanwhile, market demand should stay weak. This could mean more challenging times ahead for the Chinese anode market.

Cathode

Nothing new to report

Aluminum Fluoride

Nothing new to report

The following article appeared in the China Daily. Recognising that the China Daily is hardly a worthy unbiased reporter, nevertheless there are some encouraging signs. Exports continue to be a drag, but this was always going to be the case.

By Wang Bo (China Daily)

Updated: 2009-04-08 07:43

The government’s $586-billion stimulus package may be strong enough to drive the economy to an early rebound in the middle of this year, the World Bank said yesterday, adding a caveat that a full recovery ultimately depends on developments in the advanced economies.

“Fueled largely by the huge economic stimulus package, a recovery in China is likely to begin this year and take full hold in 2010, contributing to the region’s stabilization,” the bank said in its latest semi-annual report on the economic health of East Asia and the Pacific region.

“A wide range of economic indicators in China are improving,” indicating that a recovery is underway, said Vikram Nehru, the World Bank’s chief economist for the East Asia and Pacific region.

The Purchasing Managers Index of the manufacturing sector, a key indicator of economic health, rose for four consecutive months to reach 52.4 in March. It was the first time it rebounded above 50 since July 2008, indicating a “stabilizing and recovering economy”, said Ma Jiantang, head of the National Bureau of Statistics at the release of the figures.

Urban fixed asset investment surged by 26.5 percent in the first two months of this year, and new yuan loans reached a record high of about 2.7 trillion yuan during the same period, pumping in massive liquidity to prop up the slowing economy.

A recent survey conducted in 19 countries showed that Chinese are more confident of their economy than in many other countries. Nearly one in two Chinese respondents believed the country’s economy was getting stronger, while in Japan and the UK, more than four in five said their economies were getting worse.

“We are seeing these encouraging signs (in China) and we do think the stimulus policies will allow China to continue to see some growth in a very weak world economy,” Louis Kuijs, senior economist with the World Bank, said.

But he warned that China’s growth could not return to the rate it used to be without a recovery in the global economy.

The Chinese economy is so closely linked to the world economy that it is impossible to expect the stimulus package alone to boost growth back to above 10 percent, he said.

China will expand 6.5 percent this year, the World Bank predicted last month, down from an earlier forecast of 7.5 percent and compared with 9 percent last year, as export demand weakens in the United States, Europe and Japan, its key trading partners.

Li Jianwei, senior economist with the Development Research Center affiliated to the State Council, agreed that the economy could pick up in the second or third quarter as the effect of the massive fiscal spending begins to show, but stressed it was too early to say the country is on the way to an overall recovery.

“Given the gloomy outlook for the developed economies, such as the United States and Europe, China’s economy is still under huge downward pressure in the medium term,” he said.

Alumina

The National Strategic Reserves Board (SRB) purchases of aluminium have begun to positively affect the domestic alumina market. Last week, imported alumina prices rose US$20/tonne to US$230-240/tonne. Meanwhile, domestic non-Chalco alumina prices have risen RMB370-400/tonne to RMB2300-2350/tonne, while the Chalco price went up RMB100/tonne to RMB2300/tonne.

Aluminium

Thanks to SRB purchases, Chalco’s aluminium prices rose RMB400-500/tonne to RMB14100-14200/tonne last week.

Green Petroleum coke

Conditions on the market for petroleum coke have carried over from the prior week. Last week saw more refineries beginning to cut prices -and with the exception of coastal areas where lower prices are already in place, northeastern provinces have started to adjust prices downward.

The significant increase in low sulphur coke prices in the northeast over previous periods has both exacerbated operating cost pressure on downstream plants, and caused demand for low sulphur coke to decline. The price of low sulphur coke in northeastern China is expected to decrease further.

The price drop in Shandong province and northern China has been marginal. The price gap between Petrochina refineries and local refineries normally stands at RMB 150-200/tonne. As the operating rate at local refineries increases, the price of coke may further slide in Shandong and northern Chinese provinces.

Coke prices along the Yangzi River were RMB1150-1200/tonne last week. Prices are considered to have already reached a bottom, and the market is expected to stabilize.

The lower end of high sulphur coke prices dropped to RMB780/tonne -close to expectations for a floor of RMB 750/tonne.

Calcined Coke

Along with the decrease in green coke prices, last week saw low sulphur CPC prices dropping RMB200/tonne to RMB2100-2200/tonne, moderate sulphur coke prices declining to RMB1500-1600/tonne, and the prices for high sulphur coke down RMB100-150/tonne to RMB1350-1400/tonne.

Meanwhile imported GPC continues to sit for sale at the port level -which is prompting many buyers to wait and see where prices will go next.

Coal Tar

Coal tar suppliers have been speeding up their price increases, with prices rising to RMB2000-2100/tonne in Shanxi province, to RMB2100-2300/tonne in Hebei province, and to RMB2300/tonne in Shandong province.

The word is that not only are prices climbing very fast, but several suppliers could also already be running out of supplies -there is a chance, however, that some suppliers may actually be holding goods from the market to try pushing prices higher.

Coal Tar Pitch

Driven by a shortage in coal tar and the rise in coal tar prices, the increase in domestic coal tar pitch prices continued last week. Prices in Shanxi province rising to RMB2050-2100/tonne for modified pitch, and to RMB2000/tonne for moderate temperature pitch. In Hebei province, the price for modified pitch rose RMB200/tonne to RMB2300/tonne, while moderate temperature pitch prices increased to RMB2150-2200/tonne. In Shandong province, the modified pitch price rose RMB150/tonne to RMB2350/tonne.

While exports remain the best alternative for Chinese coal tar pitch producers, the sustained rise in domestic prices could put significant pressure on export growth.

Anode

Mainstream anode market prices remained unchanged at RMB2600-2800/tonne last week. Actual prices, however, have increased in Shanxi province, Inner Mongolia and Guangxi province.

The quoted price in Shanxi province stood mostly around RMB2700-2800/tonne, as it does currently in Shandong province. Meanwhile, some high-end anode in Henan province sold for RMB3100-3150/tonne, while mainstream prices were around RMB2600-2800/tonne.

Domestic market demand for anode has increased thanks to the purchases of aluminium by the SRB, while export demand remains very weak.

Anode producers in China have to deal with the issue of high inventory.

Cathode

Cathode block prices slipped slightly compared to the previous month.

Cathode manufacturers in China mainly produce vibration molding cathode block. The price of vibration molding 30% graphite block stands at around RMB 6500/tonne (ex-factory price plus tax), while 50% graphite block currently sells for RMB7000-10000/tonne. Only a few cathode manufacturers based in Gansu, Guizhou, Qinhai, Henan and Yunnan provinces produce extrusion molding block. Given longer usage life, extrusion molding block is more expensive than vibration molding block. Extrusion molding 30% graphite block is currently priced at RMB7800-8000/tonne.

Aluminium Fluoride

The month of March saw the price of aluminium fluoride continue to decline by another RMB300/tonne. The listed prices for aluminium fluoride were RMB4500-6000/tonne for dry method fluoride and RMB4500/tonne for wet method fluoride. Currently, few manufacturers produce aluminum fluoride using the wet method, and supply of wet method fluoride is limited. Chalco’s purchase price dropped to RMB5200/tonne from RMB 5500/tonne.

There were no significant changes on the raw materials side. The price of fluorspar stands at RMB1200/tonne, and the price of aluminium hydroxide is RMB1300/tonne. The listed prices for cryolite, on the other hand, slumped to RMB4200-5800/tonne.

The recent rebound in primary aluminum prices should support an increase in aluminum fluoride prices. However, the late shift within the aluminum industry does not appear to have had an impact yet on the aluminium fluoride market.

As at the end of March, the quoted prices for aluminium fluoride (dry method) were RMB5500/tonne in Hunan province (where monthly production stood at around 10,000 tonnes), RMB4900-5000/tonne in Shandong province, RMB4800-5000/tonne in Zhejiang province and RMB5000-6000/tonne in Henan province.

One feature of the coke and carbon market is that once it’s in the blood, there’s no escaping. This is a market where folk can easily spend decades of their life, building friendships, knowledge, reputation and profits.

I had the good fortune to meet with Clive Webber at TMS in San Francisco recently. Clive is Product Manager for specialty coke in Europe for ConocoPhillips. Clive agreed to let me interview him for the Blog, subject to his corporate people screening the answers. The following interview took place by email. My thanks to Clive for the interview, and to COP for their approval.

As an Australian, I had had little exposure to COP, so I started by asking Clive to tell me about ConocoPhillips. Here is the interview.

Clive, for starters, can you tell me a little about ConocoPhillips’ involvement in the petroleum coke industry? How many refineries do you have? How much coke do you produce? What is the split between calcinable and fuel grade?

ConocoPhillips (COP) is unique to the coke world in that it is the only company that manufactures every grade of the product i.e. calcined needle, anode, recarburiser and TiO2 cokes plus fuel and anode-grade green coke. We also licence our fuel coke technology to others; about one third of the world’s cokers are covered by our licences. We have 17 refineries (including four Joint Ventures) of which 13 are involved in coking and three have integrated calcining plants. In total, COP produces and markets about 6 million tons of fuel coke through our Houston Commercial group, and about 1 million of anode green coke and 1.1 million of calcined coke through our Global Specialty Petroleum Coke Group (GSPC) in Houston and London

What about you personally Clive? How long have you been in this industry/market? What is your background?

I joined COP’s London office in 1970 straight from University where I did a business degree. I started scheduling small tankers around Europe but within weeks got involved in the coke shipping and planning from Humber Refinery. Within three years I was doing nothing but coke. As I developed, the ship scheduling was expanded into production planning, quality control, administration and by the end of the 1970s I started selling.

In the 1980s I also got involved with the marketing of the Lake Charles refinery new fuel coker in the United States, helping to get that off the ground in Europe. Then in 1993 I was given my current job, still in London, with responsibility for the marketing of everything at Humber Refinery that is not needle coke. This covers selling calcined coke to aluminium, recarb and TiO2 customers in Europe and sometimes beyond; managing our calcined coke tolling arrangement in Spain; selling or purchasing any green coke that we need to balance the Humber system; and then selling all the coke fines that arise from the 600 kmt of calcined production at the plant. I’m now blessed with many friends in the industry who have been around ‘almost’ as long as I.

2008 was a strange year for all of us, with the market doing a 180o turnaround. How was ConocoPhillips impacted by this?

2008 was not an easy year. The high crude price put integrated producers under tremendous pressure. Fortunately, the sharp decline also gave an opportunity to respond to the aluminium industry needs in 2009.

The market for calcinable coke is slowly but surely shifting towards the Middle East and China. What is your strategy to adjust to these shifts?

We acknowledged in 2008 that the marginal supplier of calcined coke to the world is now China, not the US Gulf which had previously always had this role. This recognition contributed to our flexibility as we put the 2009 business together. The issue in Europe is how to balance the more volatile spot pricing from China with the traditional European term business.

There’s a lot of talk every year about the requirement for smelters to re-think their coke specifications, and of the need for NTACs (non-traditional anode-grade cokes). How does ConocoPhillips view this debate? How real is the need for this shift?

Today’s refinery technology and economics don’t easily lend themselves to sweet crude coking. As the aluminium industry continues to grow long term, it has to adjust to the available coke quality, which on average will keep gradually deteriorating. 2009 has given them a breather year or two, but I believe in the medium term coke specifications and NTACs will be back on the agenda

We have just seen another TMS go by. How do you read the mood at this one compared to recent years? What were the key messages that you heard from it?

One message came across clearly: the aluminium industry is really suffering right now and needs all the help that can be reasonably given. With plenty of coke about it is much harder for the buyers to work out their best purchases to optimise value to the smelter. I sense many smelters are looking at new cokes, which has made 2009 a year of transition for many and the market more short term at present.

What is ConocoPhillips’ view of the China market, from a coke perspective? Do you envisage a greater role for your company in the coming years, in coke?

We continue to grow our long-term needle coke sales in China and expect to continue to sell cargoes of anode and fuel green coke there. We have also in the past purchased Chinese green anode coke for use at Humber. I see China as a major market influence for COP’s non-needle coke business. My expectation is that China will always have enough coke for its own aluminium industry and then export the rest so setting the world’s marginal price.

Finally, what about Clive when he isn’t at work? What are your hobbies and interests? Family? Pets?

I’m a one-job, one-wife man that makes up for it in cars! I enjoy driving. My kids are 33 and 29. My son is a British Airways pilot and my daughter is a retail merchandiser, busy with careers and showing no signs of grandchildren yet! My wife and I enjoy long-distance touring holidays and have now seen a lot of Australia, New Zealand, South America and North America. I also take far too many photos. Thank goodness for digital photography; we were running out of room for all the albums!

Chinese scientists working at a top secret laboratory in Siyue Yihao in China’s Ganbei province have developed a new process for reducing alumina into aluminium.

“For a century and a half, the fundamental process for producing aluminium has not changed”, said Shazi Xiaohua, head of the research team. “But we have discovered a method that eliminates the need for vast amounts of electricity, voids the use of carbon electrodes and vastly improves environmental emisions.”

Exact details are not clear but it is understood that the new process involves immersing alumina in vast amounts of Chinese alcohol, called Bai Jiu, then placing the mixture in a centrifuge. “Think of it as a gigantic cocktail shaker”, said Mr, Shazi. “Only Bai Jiu is potent enough to separate the oxygen from the alumina molecule. The real secret is in discovering the exact proportions of alcohol and alumina to be used in the mix. It’s taken us years of research, but we finally have the blend right.”

Apparently the process still has some flaws. Since Bai Jiu is distilled from grains such as sorghum and wheat, and contains up to 60% alcohol, side effects from being near the centrifuge when it is working can be tremendous. “It’s true some of our scientists were a little under the weather as a result of our experiments”, said Mr Shazi. “Fumes given off by the process are nowhere near as harmful to the environment as in the current smelting process”, he added. “It’s true that anyone who breathes the fumes may become intoxicated, but that’s much better than pumping all that CO2 into the air”.

Another imperfection is that the metal produced by the process comes out with a yellow/green colour. It is understood this is due to the grains used in the distillation of the alcohol. When asked about this, Mr Shazi pointed out the many benefits, such as reducing the need for painting or anodizing the metal, adding colour to otherwise dreary window frames and giving the world green airplanes. “The modern trend is for a move to a greener world, so what better contribution can the aluminium industry make?” said Mr Shazi.

With the new technology, pots will now be called shakers. Pot covers from now on will be moulded in the shape of a bamboo umbrella. Pot tools will be called swizzle sticks.

It is believed a trial plant is already being planned for the nearby city of Jiuzuide in Ganbei province.

Senior people from the Chinese carbon industry refused to comment on these developments, although the price of calcined coke, anodes and cathodes have all dropped dramatically.

We at AZ China are unable to confirm all the details in this story. We can however confirm that people who drink Bai jiu often wake up the next morning looking a distinct yellow/green colour. We will keep our readers fully informed as more information becomes available.

Chinese to English translations:

Siyue Yihao - April 1st

Shazi - fool

Xiaohua - joke

Jiuzuide - Drunk

Ganbei - “Cheers, Bottoms up”.

Bai Jiu - a Chinese liquor, distilled from up to 5 different grains, with alcohol content of 40 - 60%.

0