Category Archives: Refineries

Many of you would have read of the explosion in Qingdao last Friday. Authorities say at least 55 people were killed in the explosion, with another 136 injured and 9 still missing.

But the explosion could parlay into problems for the aluminium industry. The pipeline ran crude oil from Qingdao to Sinopec oil refineries in Weifang and surrounding areas. Weifang is about 170 kilometres from Qingdao.

Already Jinan refinery, Qilu refinery and Qingdao refining group have decreased output 20% to 40%, in the days since the accident. Each refinery will be impacted differently, according to how much inventory they had at the time of the accident. Sinopec is reportedly talking to some of the small independent refineries in the area to provide product for Sinopec customers.

The design capacity of the pipeline is max. 10mtpy. Of course, pet coke is a waste product for refineries, so output of coke will be impacted to differing degrees. It is still too early for an official timetable of repair and restart of the pipeline, but there’s no doubt it will be brought back on line as quickly as possible, to preserve jobs in the area.

The coker capabilities of major refineries which were influenced by this incident are: Cangzhou refinery with capacity of 1.2mtpy, Jinan refinery with capacity of 1.2mtpy, Qingdao refinery with capacity of 1.6mpty, Shijiazhuang refinery with capacity of 800ktpy, Shengli oil field with capacity of 400ktpy, Qilu refinery with capacity of 2.8mtpy and Qingdao refinering Group with capacity of 2.5mtpy.

We estimate the total output of petcoke from these refineries will reduce by a combined 284kt per month. This includes anode grade coke output of 130kt and fuel grade coke output of 154kt. In a country that produces about 24 million tonnes per year of pet coke, this is a small percentage, but anode coke is already looming as a potential shortage in the new year.

We will continue to monitor the situation. Subscribers to our reports will receive more information in our next editions.

(Thanks to AZ China’s Ji Yuan for compiling this information.)

Excerpted from our monthly India report, email [email protected] for subscription details.

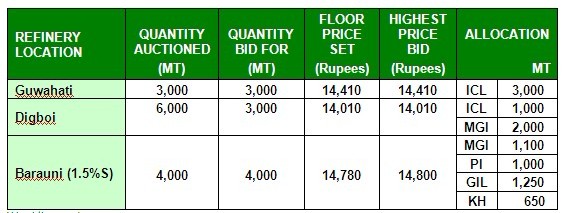

Indian Oil Corporation (IOC) conducted GPC e-auctions on 29 January 2013, and the results of which for three refineries are tabulated below.

Abbreviations used: ICL – India Carbon Group; MGI – Maniyar Group of Industries; GIL – Graphite India Limited; PI – Premier Industries; KH – Krishna Hydrocarbons

September/October is probably the second most popular time for refineries to do maintenance. Summer is very popular, while this time of the year allows refineries a clear run during the peak demand times in the winter months.

Just look at the list of turnarounds:

- Sinopec Shanghai Petrochemical shut down an 8-mil-mt/yr crude distillation unit on September 17 for a month-long turnaround, with two cokers working in turns. GPC production will reduce to half in this period.

- Sinopec Jiujiang Petrochemical delay coker shut down on Sep 20 for a 40 days turnaround;

- Sinopec Luoyang Petrochemical started 45 days turnaround from August 31;

- Sinopec Changling will start 45 days turnaround from September 25;

- CNOOC Huizhou may go into maintenance after the October holiday.

CNOOC has reported that a fire erupted at their Huizhou refinery this morning, forcing the closure of their 800,000tpa aromatics unit. No reports of injury or fatalities, and the fire was apparently brought under control relatively quickly.

We understand there will not be any interruption to coke production.

The word is out that Bechtel have purchased the coker technology section of Conoco Phillips. Several of the senior engineers have been transferred to Bechtel with the purchase, though it isn’t clear yet what this means for COP’s needle coke and specialty coke group.

One can argue that an engineering company is a better place for design and licensing of technology than a user of that technology, though I wouldn’t. I know that with Pechiney technology, the former Pechiney made as much money from sales of technology licences as it did from some other major divisions of the company. Sure, it raises problems that others in the industry have to go to their competitor to gain access to the technology, but there are ways of firewalling the business unit.

To me, this signals that COP is looking to streamline its business, and perhaps gradually lose minor segments such as coke.

In other related news, Yanchang Petroleum, based in Shaanxi province, has announced it will form a JV with KBR to market KBR’s VCC technology. VCC is a process which allows for the use of coal oil, heavy oil and other “bottom of the barrel” stocks to be processed for increased fuel production.

Editor’s update: Conoco Phillips have now supplied us with a copy of the press release on the sale of the technology to Bechtel. In their email, they also make it clear that the sale in no way represents any sort of change of strategy or intention to streamline out of coke sales. Here are the relevant parts of the press release:

Two bits of news from the China coker industry.

A fire at Sinopec’s Wuhan refinery has knocked out its coker. The main refinery has not suffered any major damage, and crude processing is continuing as normal. But the 1.5 million tonnes per year coker is out of action. The coker produces anode grade coke, usually grades 2B or 3A. That could create a supply hiccup, though the market has not reacted yet.

Shandong province’s Rizhao Port Petrochemical company has announced that its new coker is set for production, with the first coke coming out in early June. That coker will have a coking capacity of 1 million tonnes per year, according to their announcement. Presumably that is the charging capacity, meaning that coke output will be in the order of 200 - 250 thousand tonnes.

Rizhao Port is an independent refinery, not tied to any of the majors.

Acknowledgements to C1 Energy for both these stories.

There has already been quite a lot of press about how China is concerned about a possible Jasmine Revolution infiltrating into Chinese minds.

Of more immediate concern is the rising price of crude oil. Already some refineries are reducing production of gasoline, stung by the widening gap between the cost of crude and their break-even point. According to local newspapers here in China, the tipping point is $90 per barrel. Oil was sitting at $106 last time I looked.

Sinopec has already announced that they will pay rebates to their refineries in a bid to maintain output of gasoline. No doubt they will then turn to the Government looking for relief from the substantial losses they are now incurring.

Petrol prices at the pump are controlled by a formula which only allows a price increase after about 3 weeks of sustained high oil prices. But when that rise kicks in, authorities will have to worry about yet another stimulus to inflationary pressures. Inflation is already running higher than the Government wants.

Close on the heels of gasoline shortages could be a shortage of crude oil. China has only about 2 weeks supply in reserves, according to a Business Insider report. Any worsening of the situation in Libya, or a spreading to other oil supplying countries, could spell extremely bad news for China’s economy.

For those of you who are looking at Chinese petroleum coke, these developments only make the matter worse.

Reports are emerging that a major explosion has occurred at Petrochina’s Fushun oil refinery. Fushun is in far northern China.

The reports are indicating that the explosion occurred in the residue FCC at number 2 refinery, at about 9.30am this morning local time.

The number 2 refinery can process up to 8 million tonnes of crude oil per year. Its coker processes up to 2.4 million tonnes.

I will add more information as it becomes available.

Update: reports say that 30 people were injured in the explosion. Apparently the main part of the refinery is still operating. Plant management does not want to stop the process, because it would be impossible to restart until ambient temperatures rise sufficiently. (It is currently -7c here in Beijing, so how much colder must it be way up north?!)

There are separate reports of an explosion at Jilin refinery, which is also in North China, not so far from Fushun. However, it is not clear whether these reports are confusing refineries, or whether there was a separate unrelated incident. More to come.

News from around the Chinese petcoke and related markets:

* CNPC has recently announced that their expansion of the Liaoyang refinery, in Liaoning province in China’s north, has now been completed. The refinery will be the delivery point for Russian crude oil coming down the controversial pipeline that is due to start pumping this month. The refinery will take 200,000 barrels of Russian crude per day. Liaoyang makes grade 2B petcoke, and produced about 200,000t last year. It seems that the expansion did not include an upgrade to the coker. No information on what the Russian crude will do for the grade of coke.

* The other refinery that is in the Russia play is the new JV plant in Tianjin. To be built within 2 years, the plant will be part of the CNPC stable. The Russians wanted it to be fed by Russian pipeline oil, but China countered by committing other refineries to the pipeline. The refinery will cost $5bn to build, and will be capable of processing 13 million tonnes of crude per year.

* Sinopec has announced that it will run the Hainan Isalnd refinery at full speed from now on, in response to increasing demand. This refinery does not make petcoke, but it is a good sign that fuel demand is bringing increased refinery capacity into the market. This can only be good for petcoke supply.

* Sinopec’s Maoming refinery, in China’s far south east, will close one of its two cokers for maintenance next month. This refinery produces about 1m tonnes of coke per year, but it is all high sulphur fuel grade coke.

Those of you who know the China pet coke market will know the historical importance of Gaoqiao refinery. Located near Shanghai, Gaoqiao was the source of a large proportion of the coke that ended up in exported anodes and calcined coke.

In 2006, that all changed (or so many people thought). Sinopec shut the refinery down for overhauls, and to convert it to run more sour crude oils. This was in response to the widening net that China was casting in its thirst for crude oil. Many people at the time predicted that the price increases that we saw in 2007 and 2008 were due in part to the relative shortage of anode grade coke.

Problem with that theory is that Gaoqiao coke is marketed and used as a blend stock by most of the producers in the Nanjing region. Although it’s true that sulphur levels are now higher that they were (from 2 - 2.5% to 4 - 4.5%), the reasonable metals and good structure make this a great coke for blending down the cost price.

This article is from Reuters.

Sinopec Corp. plans to raise crude processing at its Gaoqiao refinery to a record high in August as a new crude unit revs up, an industry source said on Friday.

The plant is expected to process about 248,200 barrels of crude oil per day in August, up 13 percent from July, according to the source.

“The new 100,000-bpd CDU will run 87,600 bpd this month, up from 51,100 bpd previously,” the source said.

The new unit has been on a trial run for months and operations are steady now, allowing the plant to dismantle a decades-old 66,000-bpd crude unit, the source added.

Gaoqiao now has crude capacity of 260,000 bpd.

0