Category Archives: anodes

AZ China has completed its analysis of the cash cost curve for Q2 2014. Overall, costs went down, but not enough to save many producers.

The analysis threw out many interesting details:

- The average cash cost of production came in at RMB14,150/t (US$2,280). This is a reduction of 2% over Q1.

- The spread of costs ranged from below RMB11,000 (US$1,775) to over RMB16,500 (US$2650).

- Costs went down primarily due to government subsidies reducing the cost of electricity, though the falling price of coal helped some smelters to achieve a lower electricity cost without bureaucratic intervention.

- Surprisingly, alumina costs went down. Cutbacks in primary metal production earlier in the year left the market long in alumina, forcing the price down. With Indonesia no longer supplying bauxite, this input cost is set to rise.

- Other input costs also went down. Anode prices fell thanks to the cost of carbon falling, while over-supply of ALF3 caused that market to reduce prices.

Across the quarter, Shanghai metal prices rose 5% over the lowest price seen in 2014. This and the falling costs have provided relief to the financial performance of smelters. The “break-even point” along the x-axis has shifted right a little, crossing at about the 30% point.

For the record, AZ China has 129 smelters in the total population, but we exclude any smelter which has less than 2 years of data. This means new smelters which are still “bedding down” are excluded, as are smelters which have been idled. Based on our selection criteria, 73 smelters qualified for this analysis.

There will be a more detailed analysis issued to our subscribers. If you are not on our mailing list, please contact us at [email protected].

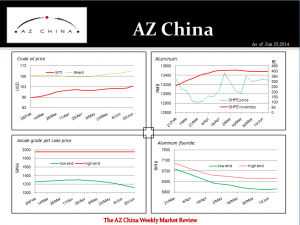

Dear readers, here is our latest “Weekly Report Review” . If you have any questions or requirements please tell us, thanks!

Energy

With Iraq tensions increasing, crude oil prices climbed to a new level and stood at $107.26/t last week. Focussing on the domestic market, the coal price fell further due to high inventory. A situation that leads traders with a negative outlook to think the price will go down.

Alumina and aluminium

Import prices remained stable last week, however imported material is uncompetitive when compared with domestic alumina. For aluminum, there is no positive change in the downstream market. On-demand procurement volumes were limited to sustain price increase. Last week, aluminum price went down slightly.

Raw material of AL

Although downstream demand continued be weak, refineries controlled their output to a relatively low level which helped petcoke prices stabilize. With oversupply and tighter cash-flow within the industry, they can’t push the prices up easily. Additionally, as demand for aluminum in the main market has shown no sign of a rebound, the price might drop again.

ALF3 price continued to rise due to the low inventory levels, increasing by ¥50/t WoW. For good news, fluorspar prices started to rise slightly.

Sometimes, tough medicine is needed. But right now, in the Chinese aluminium industry, pain killers are being handed out, when what’s really needed is some stronger medicine.

Since the beginning of June 2014, more and more smelters that shut down in recent months now plan to restart. The motivation was not the rising prices or increasing demand, but local government pressure. In exchange for restarting, local governments will guarantee a subsidy to reduce the losses. For instance, most smelters in Gansu province have received a subsidy of 0.03/kwh, especially for non-captive power plant smelters. Meanwhile, Guizhou province has issued subsidies to Chalco Guizhou, Chalco ZunYi aluminum, and others. The rumored subsidy was 0.12/kwh in Guizhou province because their original power price was much higher than other provinces.

These subsidies are just a pain-killer which might bring more potential painful problems.

Local governments have to protect their tax revenue, and they have to protect jobs. Many aluminium smelters are the hub of local industrial zones, with feeder industries that employ ten times the number of employees in a smelters. But with more smelters restarting, aluminium prices will fall once again. Soon the low metal price will trigger other capacity shutdowns - and a vicious cycle begins!

In short, the subsidy may ease the current pain, but for a long- term solution, surgery is needed, not just medicine.

As always, these actions from local governments are not uniform. Based on our analysis, the subsidies so far seem to be favouring state owned enterprises. The small guys are missing out.

Dear readers, our latest “Weekly Report Review” has been published. if you have any questions, please tell us. Thanks!

Energy

Iraq tensions drove oil price up sharply last week. But domestic coal prices remain stable. Although coal consumption is increasing in summer, but potential negative factors continued to work, especially high level stock and decreasing ship transport fee.

AL

Compared with increasing spot alumina price, limited trade volumes of imported alumina continued to suppress prices, which still remain at a low level. However, aluminium prices continued to climb slightly.

Raw material of AL

After a adjustment in petcoke prices, last week both anode and fuel grade coke prices remained stable. But for anodes, because of long term weak demand and reducing exports, anode prices declined last week.

For other product, ALF3 rose further last week due to the low level inventory. The total aluminum fluoride stocks held by the 17 main plants decreased by compared with April.

For more information on subscribing to this report and getting the full picture, contact us at [email protected].

Dear readers, our latest “Weekly Report Review” has been published. If you have any question or need please tell us, thanks!

Weekly Report Summary: last week, most products prices remain stable.

Energy

Due to good US nor-farm data and ECB reducing rates, Crude oil price rose slightly last week to $102.66/t. But coal prices remain at a low level because of domestic weak demand and passive sentiment.

Aluminium and alumina

Imported alumina prices fell again last week due to domestic sluggish aluminium market and weak demand. Overall aluminum price showed a slightly increase to ¥13,295/t although the price is unlikely to rise much more.

Raw materials

Although recently low sulphur grade coke prices continued to fall, anode grade pet coke prices remain stable. Under the situation, other products prices remain stable except aluminum fluoride.

ALF3 low level price increased by ¥50/t because of low inventory.

Kazakhstan has only one aluminium smelter (KAS) which is owned by the Kazakhstan government and is located in Pavlodar. With annual production capacity of 250kt, KAS needs 125kt of anode theoretically. According to our database, they run at relative higher operating rate, over 95% in latest 3 years, therefore the consumption of anode was quite stable among these years. However, they sourced baked anode from China and Russia, which increased their production cost as well as the business risk of raw material supply.

Kazakhstan has delayed cokers with existing anode grade petroleum coke capacity of 370ktpa in total, which is able to satisfy carbon products’ consumption for domestic aluminium smelter. After 2 years construction, a captive anode plant was put on stream by 2013 end, with reported capacity of 150ktpa. Compared to their aluminium outputs in 2013 of 244kt, it is enough. At same time, UPNK-PV together with China NFC worked on a calcined coke project with capacity of 280ktpa in Pavlodar from the middle of 2013. It expected to start operation in the second half of 2014. They are steadily becoming self-reliant on carbon supply.

China as the principle supplier of anode and calcined coke to Kazakhstan reduced exports from the beginning of this year. During the first quarter, anode exports to Kazakhstan reduced more than a half compared with Q1 2013 to 29kt. Kazakhstan will import less and less anodes.

Although Kazakhstan has a plan to expand aluminium capacity with another 250ktpa, which may give China producers another opportunity to export, I don’t think it will happen in next few years.

(All information is available in our SPH Report for more detailed country analysis. )

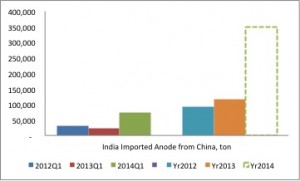

India increased purchases of anodes from China throughout the first quarter of this year, with 75kt in total. So far, India has already become the largest importer of China anodes, over Malaysia who was the largest importer in 2013. The volumes India took within first quarter 2014 were 80% of 2012 and 65% of 2013 yet, as this chart shows.

There are three principle aluminium producers in India, including Nalco, Vedanta and Hindalco. Throughout fiscal year 2014-2015, Hindalco has said they will increase output by 50% to 1Mt, mainly from their new facilities located in Madhya Pradesh and Odisha.

Nalco restarted 10 pots this week, meaning they will produce 410t more aluminium every month, and other pots will be restarted gradually. As for Vedanta, short supply of bauxite has limited aluminium production.

India’s domestic market shows aluminium demand rebounded to a certain degree, which encouraged aluminium smelters to raise production. At the same time, new capacity will consume more anodes in the coming months. Even if we only take Hindalco and Nalco’ s added production into account, India needs 275kt of extra anodes.

There doesn’t appear to be any change of strategy; the increased purchases of anodes seems to be a direct consequence of increased metal production.

For registered attendants of AZ China’s 4th International Aluminium and Carbon Conference, on the night of Tuesday, May 6, 2014 there is an option: to Gala, or not to Gala? That is the question.

But what is the measure of our decision?

If our minds long to be entertained, dulled by the weary excuses for conference entertainment we so often see – we say yes! Our pre-dinner traditional Chinese entertainers are as charismatic as they are alluring.

If our hearts yearn for delectable cuisine so scrumptious our watering mouths flood the lands – we say yes! Guests will dine at 7:30pm in picturesque Houhai, a reclusive lake smack dab in the middle of Beijing surrounded by enticing nightlife.

Diners will be served a scrumptious assortment of seasonal dishes, basted and broiled to perfection.

If our bodies long for an adventure we haven’t had since our misspent youth – we say, why certainly, yes! A convenient adventure that is; guests will be promptly and safely delivered to and from each stage of the Gala journey and still get back to the hotel early enough for a good night’s sleep before the final day of the conference. If you’re a night owl, you’ll also have the option to stay and kick back at the surrounding neon-lit guitar bars for a lakeside beer or wander around the lake at your own pace.

But don’t be fooled by the guise of just a great meal and environment! The evening has cunningly disguised networking opportunities for the benefit of guests’ business development as well as their enjoyment and relaxation.

How to get on board the Gala Dinner train?

On the registration page of the conference, there is an added option to attend the Gala dinner. For those who have already registered and did not check the option but would like to attend, you may pay for the Gala dinner at a later point, although we can’t guarantee available seats. There are already a very limited number of remaining spaces available. Register soon for a great night in the heart of Beijing!

Unlike this divisive Gala occasion, AZ China’s Gala Dinner won’t be half as awkward!

An interesting press release landed on my desk the other day.

According to the press release, China’s Chalieco, the engineering division of Chinalco, has signed an agreement with an Australian company for the supply of graphite from a mine in Mozambique. The press release was issued by the miner, a company called Syrah Resources, and in it, they say that Chalieco plans to use the graphite for the production of anodes for the aluminium industry, among other things.

If Chalieco is going to start using graphite in anodes, even in blend proportions, they are introducing their cousins in Chalco to a world of serious potential pain.

Graphite has superior properties to petroleum coke, especially in relation to the electricity that passes through the anode. Graphite has a lower resistance to electricity, and allows the electricity to pass through more easily than petcoke does. Graphite has less impurities than petcoke, so there is less to get into the pure aluminium metal that is generated by the electrical process.

All sounds good, so what’s the problem? Actually, there are several problems, real and potential. In the first place, graphite is more expensive than petcoke, and this material will have to be imported from Mozambique.

But the problems are not just economic ones. Graphite expands at a different rate to petcoke when heat is applied to it. If you have some part of the anode expanding at a different rate than the rest of it, you open yourself to problems of cracked anodes. Second, you need to make sure that you have exactly the same amount of graphite in every anode in the pot. If you don’t, then each anode will perform slightly differently, and eventually the pot will become unstable. Finally, although you gain the improved/lower electrical resistance, you only gain that benefit for the proportion of the anode that contains the graphite, meaning the net result in operating costs is tiny, and not worth the increased cost of raw materials.

And all these problems are being introduced into a company that has a poor record when it comes to anode manufacturing and pot operations.

The press release was written by the folks at Syrah Resources, who seem to have taken Chalieco at their word*. In the press release, another purpose for the graphite was listed as being for production of the cathode - the electrical terminal at the bottom of the pot. Graphite is already used in some cathodes, and China’s graphite industry verges on being a State Secret - it is tied up by a small number of players, with complete opacity. But the same question remains - why bother importing graphite all the way from Mozambique?

I hope that Syrah Resources has received Chalieco’s payments on this deal.

* The press release also says that the aluminium industry uses 13 million tonnes of anodes a year, at a rate of 560 kgs per tonne of metal produced. Really? In China maybe, and at an old smelter.

We recently met up with anode virtuoso and Managing Director of Aminco Resources, Michael Wrotniak in Beijing. For readers who aren’t familiar with his background, here’s a brief intro:

I’ve worked for Aminco since 1991 when I was introduced to my two current business partners by my father who spent his career working for Great Lakes Carbon and is considered to be one of the grand-fathers of this industry – a term he does not consider as being too complimentary. Prior to joining Aminco, I worked for a German trading company and have focused on the aluminum industry for almost 25 years.

About 10 years ago, I first met Paul Adkins, who was working at Tomago at the time, wanting to sell him a trial shipment of anodes. Through a unique turn of events, he went from being not interested to ordering a huge shipment from us. We’ve been great friends ever since.

What is the focus area of Aminco?

Aminco focuses on supplying carbon raw materials to basic industry, which is primarily the aluminum industry but we do have some exposure to steel. And in prior times, to the chemical industry as well. We continue to consider opportunities outside of this space, but carbon will always remain a core compentency.

What does the future hold for the company and what sets you apart?

I see Aminco becoming more than just a supplier of raw materials to the aluminum industry. We have always tried to add value to the products we provide. That concept was the genesis behind our partnership with R&D Carbon, enabling us to provide world-class quality anodes out of China when that wasn’t available. It also enables us to get into the pot rooms with our customers to understand how our anodes perform versus other anodes and also to make suggestions about quality variations and quality modifications that can help a smelter. Going forward, we’d like to spend more time in the pot rooms and the carbon plants of our customers and look forward to some new opportunities that will develop from these efforts

Our competitive advantage is quality. We are breaking new barriers in resistivity and anode density. The productivity of our carbon is far superior to that of our competitors and that quality advantage translates to lower conversion costs for a smelter. Our specs are tighter and we guarantee a limited variability. We can therefore mitigate the smelter’s performance risk through our specifications.

How do you see the market currently?

Challenged. We’re losing Al production in the West even as we are metal gaining production here in China. With a low LME, smelters are more focused on adding value to their products and they are, in certain ways, deferring expenses and capital requirements in their carbon plants. When the focus is purely on cost, it is tough to make a good anode. But we’re looking at these challenges as opportunities. And we’d like to take this opportunity to thank our customers and partners who continue to support Aminco.

Aminco has been a sponsor of the AZ China International Aluminium & Carbon conference for several years, what are you most looking forward to at the upcoming May conference?

Exchanging info is always great. But we want to know what surprises the future holds. We can all see that the market is challenged with depressed demand for carbon in the West. But what’s next for the industry? I hope we can find some answers at the conference.

For more info on Aminco, click their logo below.

0