Monthly Archives: January 2014

If you are planning to attend the May 5-7 conference in Beijing, this week is the best time to register. The super early bird discount of $600 off the regular price will expire on January 31. For more details about the conference, head over to https://conference.az-china.com

Note: The AZ China office will be closed as of January 30 for the Chinese New Year and will re-open Feburary 7.

AZ China has recently completed its analysis of China’s cash cost curve for Q4 2013.

The most significant feature arising from the Q4 curve is the evolution over 2013 in terms of break even. What has happened is that even though the metal price has declined over the year, the number of plants and the percentage of China’s total capacity on the positive side of the ledger has improved.

Additional analysis is provided in the full client briefing note which is provided to AZ China clients as a free service.

For more information about the cash cost curve, and where other companies sit on it, please contact us at AZ China. We are about to enter into the Chinese New Year holiday, but one of us will be available most times to answer your questions.

The International Aluminium Institute has published the figure for China’s December aluminium production.

December came in at 1.93 million tonnes, which is something of a surprise. With 31 days in the month, it calculates out to 62,300 tonnes per day. This is a fall of just over 4% compared with November.

For the year, the IAI numbers show China produced 21.9 million tonnes, plus another 2.4 million tonnes of “unreported production.” This is code for plants such as Hong Qiao and one or two little plants that aren’t recognised by the China Nonferrous Industry Association. Since Hong Qiao has at least 2.4 million tonnes of production, we can safely add this plus a smidgeon more, and come up with a real figure of 24.5 million tonnes.

We have not see any significant closures in the last couple of months to justify a fall of 4% last month. But it is worth remembering that the daily production rate is still or very close to record rates. December’s rate of 62,300 tpd compares with October’s rate of 62,900 and September’s rate of 61,900 tpd. In that context, November’s rate seems a little high.

But it is not uncommon for China’s monthly figures to have peaks and valleys that don’t bear any relationship to reality. The trend however is more indicative, and the recent trend has been relatively flat. That’s because although there have been some smelters in the Northwest of China complete their construction phase and start turning on the electricity, they have yet to make a significant impact on the supply number. It takes up to 12 months for a modern smelter to get to 100% efficiency.

South Africa’s Bayside Aluminium smelter looks set to close later this year, after BHP Billiton announced that it is conducting talks with employees on mitigating job losses.

The plan would be to retain the casting operations using liquid metal from Hillside smelter.

Bayside is the baby of the smelters in that corner of the world, with Mozambique’s Mozal smelter being the third. Bayside produces only 97,000 tonnes, so it will not make a huge dent in the total supply equation, though any loss of supply is like to help keep a floor under the price.

AZ China recently announced that Dr Geoff Raby will be the key note speaker at our upcoming conference.

Let me tell you why you need to hear what Dr Raby has to say.

I first met Geoff Raby at the Australian Embassy in Beijing in 2007, when he had just arrived as Australian Ambassador. Geoff spoke then of his passion for getting to know China, and how his term in office would be one of learning and leading.

During Geoff’s term, he dealt with many difficult issues, not least of which was the arrest of Stern Hu, the Rio Tinto executive charged with accepting bribes. During Geoff’s term, Australia’s position as a supplier of iron ore, bauxite, coal and other commodities grew exponentially. China’s economic engine also overheated during this time, and the Global Economic Crisis of 2008 led to the famous RMB4 trillion injection into the Chinese economy.

Geoff has the rare achievement of having visited every province and SAR in China, and was the longest serving Ambassador to China, from a country that was one of the first to recognise China in the 1970s.

Geoff’s term in office gave him an unparalleled view of what was going on inside the corridors of power in Beijing. When Premiers and Heads of State visited China, it would be Geoff that you saw sitting alongside these people, across the desk from President Hu Jintao and Premier Wen Jiabao.

So it is no stretch of the truth to say that Geoff has had an extraordinary opportunity to understand deeply how things work at the very top of the tree inside China Inc. The complex intertwine between the Chinese Communist Party, the Chinese Government and the many government departments, State Owned Enterprises and major international corporations.

Combine that knowledge with Geoff’s doctorate. Dr Raby has a doctorate in economics. And combine it with Geoff’s exceptional ability on stage, in front of large audiences.

I saw Geoff give a speech at a “Roast” - an event held to see him off from his Ambassadorship and into the realms of being a private citizen. I can’t repeat some of the stories he told, but I can tell you, he had his audience of about 200 in his hand.

It came as no surprise to anyone who knew Dr Raby the Ambassador, that he would move into corporate roles. Geoff is now on the board of Fortescue Metals, and is also Chairman of the Board of Smarttrans, a company involved in China’s growing mobile apps market. Geoff speaks excellent Chinese, and if you get the chance, ask him about his art collection, especially his North Korean works.

The spectre of rampaging mid west premiums is great news for producers, who have been struggling under a low metal price for quite some time, but bad news for those who aren’t able to pass the increases on down the line. US based manufacturers had better have a pricing structure similar to those of companies like Novelis, who have a mechanism in their pricing that sees most or all the change in premium passed on to their customers.

But it isn’t just US manufacturers who will feel the pain. Those outside the US had better get ready for some pain coming soon.

With premiums fetching north of $400 per tonne, metal units in Russia, the Middle East and perhaps even South Africa will be attracted like iron to a magnet. Everyone will want to cash in on the high premiums.

But that means metal that would normally go to Taiwan, Japan, SE Asia and other markets will now not be available. Although Japan premiums are negotiated quarterly, the next round will likely be conducted in an environment where there are no spare metal units available. We could be in for a big jump in MJP premiums in Q2. The question won’t be, will a new record price be set. The question will be, how high will the new record high price be?

Those forced to pay the new record highs in the aluminium premiums in the USA may not feel like breaking into song, but they will certainly be asking “What’s going on?”

Mid West premiums shot up at the start of the year, and are now north of US$400 per tonne. (Mid West premiums are quoted in US cents per pound). They are now up 85% since October last year.

It seems, according to Barclays Bank, that a combination of events has triggered the dramatic rise. Now that LME warehousing costs are visible, and with a large difference between LME warehouse costs and those of non-LME warehouses, there is a rush to move metal out of LME warehouses. That has created a bottleneck at the “out” door of the warehouses, forcing buyers to pay extra to get their metal on time. Barclays also hint that perhaps part of the squeeze is due to a large player (unnamed) may have been caught short and had to act quickly to cover his position.

Barclays say that the spike will likely be temporary only, which makes sense when looking at their stated reasons for it happening in the first place.

But will we see a return to “normality”, or has a new threshold been established? To my way of thinking, the USA is going to be structurally short of metal over the longer term. It’s highly unlikely we will see any more smelting capacity added to the country, unless perhaps Ormet restarts. But fundamentally, the USA consumes more aluminium than it produces. Of course, it has the Quebec smelters just over the border, but that is still technically an import, and will likely not prevent a new floor in premiums being established. As the US economy recovers, and as auto and aerospace industries start to consume more metal, the squeeze on premiums is likely to only get worse.

Rusa’s Oleg Mukhamedshin warned the world 4 or 5 months ago, that the supply-demand equation is shifting to a shortage. There is precious little new capacity likely to enter the market in the next 5 years (and none in the USA, apart from perhaps a restart or two), yet demand is set to rise. Sure the aluminium market is weighed down by all the metal in inventory, but that is still only 4-5 months supply. Structurally, if that overhang reduced by half, the metal price will respond strongly.

Unfortunately for consumers, so will premiums in such a scenario. Or at a minimum, they will stay strong.

But in all the hubbub about US premiums, no-one that I have read has yet made the connection between what has happened in the USA, and what will happen in Japan, in the next round of negotiations in 2 months time. If the premiums have risen due to LME-based dynamics, then it’s likely that unless those dynamics change dramatically, and soon, Japanese buyers will soon be crying.

China’s electricity consumption reached 5.32 trillion Kwh in 2013, up 7.5% y/y, according to the National Energy Association.

Year 2013 was difficult for the aluminium industry in China. Not only the sagging metal prices, but the government published all sorts of regulations and guidelines to resolve overcapacity issues of several heavy industries, including aluminium. Yet, using IAI’s data to the end of November, and assuming December’s production is similar to November, it looks like China will finish 2013 with a production of 24.5 million tonnes, for a growth rate of 10%. Aluminium supply is growing faster than electricity supply.

According to government data, China’s aluminium industry was consuming electricity at a rate of 13,762 Kwh/T AL in 2013, down from 13,844 Kwh/T AL. If we do the maths, it means that China’s primary metal production consumed 337 billion Kwh of electricity in 2013, or about 6% of all of China’s electricity.

In fact, this ratio is down somewhat from 3-4 years ago. At the peak of the expansion of all those smelters a few years ago, China’s aluminium industry was consuming about 10% of China’s electricity. To be down 4 points when the primary metal industry has grown consistently at around 10% per year, speaks of the huge rate of growth in generation.

We will do a little research and compare China’s 6% of electricity to the rate in other countries, and give you the results in another blog post.

Matt Powell has wasted no time since his departure from Ormet. Fresh from establishing his own business, International Aluminum Solutions, Matt has formed a strategic alliance with Michael Wrotniak’s Aminco Resources.

According to the press release, Matt will join Aminco to help the latter develop “new initiatives tied to the global aluminum industry”.

Matt’s International Aluminium Solutions business remains unaffected, according to an email from Michael Wrotniak. While Matt will spend a “significant” amount of time working for Aminco, his business will be free to explore other business opportunities that do not conflict with Aminco’s interests.

Matt starts working for Aminco at the start of February, and will remain based in Ohio.

Matt and Michael will be at TMS, in case you want to meet with them.

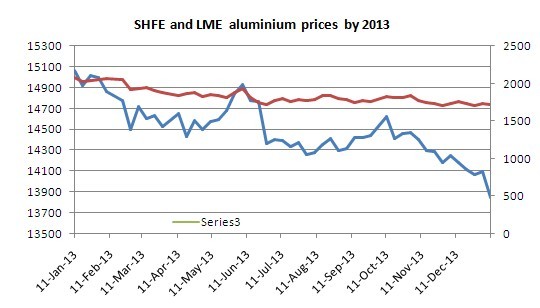

The National Bureau of Statistics (NBS) last week said China’s producer price index (PPI) fell 1.4 percent year on year in December, which has sparked concerns about China’s economy. As a direct reflection, the SHFE price fell sharply in the second week of 2014, down to RMB13,845/t from RMB14,409/t compared to last week, an 8% decrease y/y.

With the whole country about to shut down as Spring Festival approaches in 2 weeks, the domestic trading sentiment is low, and traders are waiting to see the market pick up.

As the curve shows, compared with the SHFE, the LME’s price trend was more stable in 2013, fluctuating around $1,700/t.

2