Monthly Archives: March 2014

Alcoa and Rusal each made announcements last week which further constrain the total supply equation for the world’s aluminium market.

Alcoa has announced the closure of 147,000t across two Brazil smelters, while Rusal has announced that it will not go ahead with its planned Siberian smelter. That smelter would have added an additional 750,000t to the supply side once it was operating in a few years time.

Idled capacity can notionally re-enter the market, though a number of factors have to combine. The market needs to be sufficiently strong that any metal units re-entering the market won’t drive the price down, either by themselves or across several producers each deciding the same thing. The plants themselves need to be in good enough condition and with reasonably modern technology to make it worthwhile restarting. And the plant needs to be able to access its electricity at the same or better price. Lloyd O’Carroll estimates that only 50% of idled capacity will ever return to service.

Pipeline capacity is a different question, but with a similar outcome. Once Ma’aden and Kitimat are completed, there are precious few projects around the world. Recognising that a 4% growth in demand in a market that is running at 25 million tonnes means a new smelter is needed every year just to keep up, the world is facing a future where metal prices are set to rise.

A postscript on the Alcoa announcement - I note that they allocated “$40 to $50 million in restructuring charges” to close the 147,000t in Brazil. Compare that with an allocation of $250 million for the closure of their Point Henry smelter in Australia, which was 180,000t.

For registered attendants of AZ China’s 4th International Aluminium and Carbon Conference, on the night of Tuesday, May 6, 2014 there is an option: to Gala, or not to Gala? That is the question.

But what is the measure of our decision?

If our minds long to be entertained, dulled by the weary excuses for conference entertainment we so often see – we say yes! Our pre-dinner traditional Chinese entertainers are as charismatic as they are alluring.

If our hearts yearn for delectable cuisine so scrumptious our watering mouths flood the lands – we say yes! Guests will dine at 7:30pm in picturesque Houhai, a reclusive lake smack dab in the middle of Beijing surrounded by enticing nightlife.

Diners will be served a scrumptious assortment of seasonal dishes, basted and broiled to perfection.

If our bodies long for an adventure we haven’t had since our misspent youth – we say, why certainly, yes! A convenient adventure that is; guests will be promptly and safely delivered to and from each stage of the Gala journey and still get back to the hotel early enough for a good night’s sleep before the final day of the conference. If you’re a night owl, you’ll also have the option to stay and kick back at the surrounding neon-lit guitar bars for a lakeside beer or wander around the lake at your own pace.

But don’t be fooled by the guise of just a great meal and environment! The evening has cunningly disguised networking opportunities for the benefit of guests’ business development as well as their enjoyment and relaxation.

How to get on board the Gala Dinner train?

On the registration page of the conference, there is an added option to attend the Gala dinner. For those who have already registered and did not check the option but would like to attend, you may pay for the Gala dinner at a later point, although we can’t guarantee available seats. There are already a very limited number of remaining spaces available. Register soon for a great night in the heart of Beijing!

Unlike this divisive Gala occasion, AZ China’s Gala Dinner won’t be half as awkward!

The LME continues to take one step backward for every two steps forward.

The UK’s High Court of Justice has ruled in favour of UC Rusal and against the LME on the matter of the new load-out rules that were due to come into place on April 1.

The LME’s rules, which were promulgated last year, were meant to rein in the long queues for metal at the major LME warehouses. Simply put, the rules were meant to force warehouses to deliver more metal than they received, if they had too much metal in storage already. The warehouses were at least partially responsible for the high delivery premiums that have been prevailing recently - if you want your order to be delivered on time, you had to pay extra to get your name to the top of the list of deliveries. And who were you leapfrogging to get to the top of the list? The warehouses’ deliveries to themselves, usually in the form of an order by the owner of the warehouse for delivery of stored metal to a second warehouse in their fleet.

Once the market got used to paying for the “privilege” of getting orders filled, the premiums flowed into all corners of the market.

The repercussions of the High Court ruling will play out over several weeks. With no need for larger daily delivery volumes, warehouses will continue to charge a full premium, and the producers will be happy to keep that bonus income on their books as well. That will likely lead to a share price jump for the likes of Alcoa and Century. It also comes as poor timing for those who have just finished negotiating the quarterly premiums for Japan ( but good news for Japanese buyers.) If this ruling had come down even a week or two earlier, MJP premiums would have been higher.

The major question is, what will the LME do about the ruling? Appeal? Draft new rules? Give up? One commentator suggested the LME consider moving to a new jurisdiction, where High Courts won’t find against them.

Another important question is how this ruling will affect law suits in the USA. These law suits have been brought by those impacted by the warehouses’ behaviour. If the warehouses are behaving inside the LME rules, it makes the suits more difficult.

The dancing is set to continue for some months yet.

Don’t be an April Fool! The early bird discount for AZ China’s 4th International Aluminium and Carbon conference expires April 1st, and it would be foolish to let this date slip by without confirming your attendance with us.

Send us an email TODAY. Get your name on the list before the discount expires.

www.conference.az-china.com or write to enquiries@az-china.com

郎先生更是在中国铝业具有举足轻重的地位,退休前曾任中国有色金属工业协会铝业分会会长,退休后,郎工依旧是中国铝业最高级别的咨询顾问。

如果您参加过2008年在三亚举办的首届香港爱择铝行业会议,您一定记得郎工是我们的特别嘉宾之一。

我们非常荣幸郎工作为专家再次加入我们五月的峰会。

The terrible scenes of grieving families awaiting news of their loved ones aboard MH370 has been heart wrenching. The Lido hotel in Beijing, about halfway between the airport and the CBD area has been on the nightly news almost daily.

But who was it that the Chinese government sent in to comfort and address those families? None other than Xiao Yaqing, the former head of Chinalco.

Mr Xiao, who is a native of Beijing, rose through the ranks of Chinalco from humble beginnings in one of its smelters in the south west of China. He eventually became chairman of the board, before being promoted into the State Council, China’s Cabinet. It was Mr Xiao who led the attack on the proposed merger between Rio Tinto and BHP Billiton in 2008. Hs years of running Chinalco were perhaps the most aggressive period of Chinalco’s history, though some pundits believe he handed a “poisoned chalice” to his successor Mr Xiong, who has had to deal with problems on several fronts.

Mr Xiao recently appeared in public as the leader of the investigation into the Qing Dao oil pipeline explosion that we reported on here about 6 months ago. These days he is the Vice Secretary General of the State Council. Insiders say that age 55, he is in a very good position to take a more senior role in the Party.

Right now though, he is calming the grieving relatives, no easy task.

As of mid March 2014, the aluminum SHFE spot price has decreased to RMB12855/t, down 9% compared with the price at the beginning of this year, and 12% compared to this time last year. More and more people have lost their faith for the market.

As the chart shows, from last year till now, aluminium prices continued to fall, and now it has dropped to RMB12855/t, a new record. Inventory increased drastically 75% compared to the previous month of this year.

But is it worst time? There is a famous quote: The darkest hour is nearest the dawn. For the aluminum industry, it is time to change, eliminate the old smelters and start more new ones which can resist high energy costs and adapt to the depressed market. As a market adjustment, more and more smelters had started to cut production because of the low prices and long-term losses.

In addition, government regulations are being established to curb the overcapacity.

So far the capacity which have shutdown this year have reached 815kt, with most of that occurring in March 2014. The main reason was lower metal prices, which lead to deepening losses. In addition, all the plants shutdown have the same condition - they are too old and have high energy costs. Some enterprise have made the decision that they will no longer compete, for example Zhejiang Huadong Aluminum. Some smelters said they will close the old ones but at the same time they will start new plants in Xinjiang province. In our monthly Pipeline Report, we estimate the capacity under construction is 3,800kt, and 40 per cent or so will make a contribution for the market in 2014. Contact AZ China if you want a complete list of closures.

|

Province |

Company Name |

Total Capacity(kt) |

Cuts(kt) |

Operating Capacity(kt) |

Date |

|

Guangxi |

Chalco Guizhou Zunyi |

240 |

130 |

110 |

Dec-13 |

|

Guangxi |

Chalco Guizhou |

450 |

70 |

170 |

Jan-14 |

|

Zhejiang |

Zhejiang Huadong aluminium |

150 |

20 |

0 |

Jan-14 |

|

Inner Mongolia |

CPIC Huomei Tongshun Aluminium |

165 |

30 |

135 |

Feb-14 |

|

Henan |

Henan Shenhuo Group |

900 |

100 |

440 |

Mar-14 |

|

Guangxi |

Chalco Guizhou Zunyi |

240 |

100 |

10 |

Mar-14 |

|

Guangxi |

Guangxi Laibin Aluminum |

250 |

180 |

0 |

Mar-14 |

|

Gansu |

Gansu Dongxing Aluminum |

1750 |

100 |

900 |

Mar-14 |

|

Shanxi |

Shanxi ShengYun |

70 |

35 |

35 |

Mar-14 |

|

Hubei |

Danjiangkou Aluminum |

120 |

20 |

50 |

Mar-14 |

|

Guangxi |

Chalco Guangxi Aluminum |

150 |

30 |

90 |

Mar-14 |

For the government regulations, a tiered power pricing scheme to be implemented seriously from the beginning of this year. And the key point is that power prices will remain unchanged for smelters that do not use more than 13,700 kilowatts (KWs) for each tonne of aluminium produced, while those that use between 13,700-13,800 KWs will be charged an additional 0.02 yuan per KW. over 13,800KWs will be charged an additional 0.08 yuan per KW.

Based on our cash cost data, about 40% of smelters are less than 13,700 kilowatts per tonne of aluminium produced. Smelters in the middle band represent about 18%, with the remainder in the top category. About 58% will be charged an additional cost for the tiered power pricing.

With the Shanghai spot price decreasing and banks tightening credit for aluminum enterprises, it will be inevitable that more and more smelters will cut production in the future months of this year.

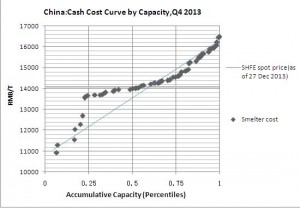

The curve below showed that, in the Q4 2013, nearly 45% of Chinese smelters were losing money as a result of the sluggish market. And in 2014, more smelters were forced to join in the losing team.

We estimated continued closures in the near future, but it is not all bad for the industry, we will welcome the dawn.

China aluminium production in February was 1833kt according to the IAI. This is down 100kt compared with January 2014. But expressed in daily run rate terms, it is a 3% increase in output. As a result, aluminum prices continued to go down, hitting new record low levels, while the implementation of tiered power pricing beginning at this year pressed on all the smelters and their cash costs.

Because of those reasons, more and more smelters shut down to reduce the losses. As of 25th March, our pipeline report shows closures this year so far are 815kt, including 10 smelters, with rumours of more cuts to come.

What the market doesn’t realise is, since at least 2010 and possibly earlier, China aluminium production grows strongly in February but declines in March. There may be several reasons for this, such as Chinese New Year, but the phenomenon occurs too often to ignore.

This increased February production, which appears to be artificially high and will likely be followed by a reduction in March (on top of some closures), and the corresponding decline in price, supports our view that sentiment has overruled fundamentals recently. We think it is likely the price will not stay at this level for long.

Russia’s Federal Bureau of Statistics data released on Thursday indicates aluminium outputs within January and February fell 14.3% y/y. They have not provided production numbers in detail, but there is no surprise on this decline.

Rusal started curtailing inefficient capacity several months ago. Looking at the published data, all the reductions occurred within 2013. The curtailment focused on the north of Russia, where they have small-scale capacities and backward technology. Bogoslovsk with capacity of 115kt, produced 103kt in 2012 but only made 41kt in 2013, dropping 60%. Soederberg technology is applied in this smelter, which is not very eco-friendly. Urals smelter has aluminium capacity of 75kt, which produced 71kt in 2012 but dropped to 32kt in 2013. This smelter is almost the oldest one in Russia, after Volkhov.

In addition to Volgograd, Nadvoitsy, Novokuznetsk (phase 1), we estimate all curtailments will be completed in 1H 2014, therefore we will see the outputs of Russia will continue going down without any surprise in coming months. If no other changes to their plan, we expect Rusal to produce 3.5mt by 2014 end, almost all will ship out from Siberia region.

Tired of going to TMS every year, to hear about what is happening in China? Why not attend the China version of TMS - the AZ China International Aluminium and Carbon Conference.

This conference, to be held in Beijing May 5-7, is being arranged to ensure you get plenty of time for your TMS-style client and supplier meetings, without having to miss important papers. The program is being arranged on a “hub and spoke” concept for each of the major topics, with plenty of time for breaks, to allow you more time to circulate or meet with clients. As well, we will be assisting that process with a few little “tricks”.

The AZ China conference is the only international venue inside China to offer you the chance to have your TMS meetings inside China.

Why go all the way to San Diego or Orlando, when you can get fully briefed right here in Beijing?

But don’t delay registering - the early bird discount price expires March 31. Click here to go to the conference website for more information or to register.

0